A vital first step toward reaching your financial objectives and safeguarding your financial future is choosing the appropriate financial advisor. Finding the ideal financial advisor is crucial, whether you’re managing investments, looking to plan for retirement, or need advice on tax tactics. We’ll give you a thorough explanation of how to pick the best financial advisor for your particular set of financial demands in this blog post.

1. Establish Your Financial Objectives

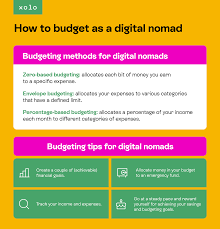

Make sure you have a clear understanding of your financial objectives before looking for a financial advisor. Do you want to reduce your tax obligations, establish a business, buy a house, or save money for retirement? Identifying your goals will enable you to locate an advisor who specializes in the particular areas that are most important to you.

2. Recognize the Various Categories of Financial Advisors

There are many distinct types of financial counselors, each with unique specializations and areas of competence. These are the most typical kinds:

- A Certified Financial Planner (CFP): Is a professional who has undergone extensive training to provide a wide range of financial planning services, such as tax preparation, investment management, retirement planning, estate planning, and budgeting.

- Investment Management and Portfolio Construction: Are the areas of expertise for Registered Investment Advisors (RIAs). They frequently have a fiduciary duty to behave in the best interests of their customers.

- Certified Public Accountants (CPAs): CPAs are knowledgeable about financial analysis, tax planning, and accounting. In addition to other financial guidance, they can offer auditing and tax planning services.

- Estate Planning Lawyer: To safeguard your assets and guarantee that your intentions are followed after your death, estate planning lawyers specialize in drafting wills, trusts, and other legal papers.

- Insurance Agent: Insurance agents specialize in offering insurance plans that guard against a range of hazards, such as those affecting life, health, and property.

- Robo-advisors: Robo-advisors are automated investment systems that build and manage portfolios according to your financial objectives and risk tolerance using algorithms.

3. Choose the Service Type You Require

Think about if you require regular financial advising services or just a one-time financial consultation. While some advisors only provide hourly consultations, others offer continuing services like investment management and financial planning. Reducing your alternatives will be made easier if you know what services you need.

4. Check Qualifications and Credentials

Make sure the financial advisor you select is qualified and has the right credentials. Seek out credentials like CFP, CPA, ChFC (Chartered Financial Consultant), or CFA (Chartered Financial Analyst). These titles signify a high degree of proficiency and dedication to industry standards.

5. Look for a Duty of Care

An advisor who has a fiduciary duty is legally required to operate in your best interests. Selecting a fiduciary advisor guarantees that their recommendations are free from the impact of commissions or other conflicts of interest. Find out if possible advisors have fiduciary status.

6. Research Background and Performance History

Examine the advisor’s background and performance history. Inquire about their years of experience in the field, the kinds of clientele they have dealt with, and their accomplishments. Regulatory agencies like the SEC or FINRA allow you to look up any disciplinary actions or complaints that have been filed against the advisor.

7. Examine your Communication Style

An advisor-client relationship that is successful depends on effective communication. Think about how well the advisor communicates with you and whether that suits your preferences. Do they make difficult financial topics understandable? Do they answer your questions and address your concerns?

8. Talk about Pay and Commissions

Be open and honest about your rates and earnings. Find out from the advisor how they are paid and if they take fees, commissions, or a mix of the two. Recognize the charge schedule and make sure it fits inside your budget and financial objectives.

9. Ask for Referencing

Never be afraid to request references from previous or present customers. Consulting with former colleagues of the adviser can yield important information about their client-focused style, level of professionalism, and responsiveness.

10. Speak with Several Advisors

Prior to deciding on a choice, think about speaking with several consultants. This will let you evaluate their credentials, offerings, and costs to determine which one best suits your tastes and budgetary objectives.

11. Assess the Investing Philosophy of the Advisor

Recognize the investing philosophy and methodology of the advisor if you are seeking investment guidance. In terms of investing tactics, are they aggressive, moderate, or conservative? Make sure their strategy fits your investing goals and risk tolerance.

12. Examine the Compliance Record of the Advisor

To make sure the advisor has a spotless record and hasn’t run into any legal or regulatory problems, look into their compliance background. Regulatory authorities are usually the source of this information.

Suggestion for Financial Consultancy Services

What does financial advisor do? Working with a trustworthy company that provides a range of services catered to your individual needs is crucial when looking for professional financial advising services to help you reach your financial objectives and safeguard your financial future. Their knowledgeable advisors may offer retirement planning, investment management, and thorough financial planning services that complement your aims and objectives.

In Summary

Selecting the appropriate financial advisor is an important choice that will have a big effect on your financial health. You may choose an advisor that knows your particular needs, offers ethical and transparent assistance, and gives you the confidence and peace of mind you need to reach your financial goals by following these steps and doing thorough research. Keep in mind that the correct advisor will collaborate with you to ensure a profitable future as a partner in your financial journey, find more here.