The ability to live life on one’s own terms without financial stress is an aspiration shared by many. This journey is not, however, restricted to the wealthy or those with extensive financial expertise. It’s a path that anyone can take, and a well-crafted financial plan is the key to getting there. In this comprehensive guide, we will discuss the significance of having a financial plan, how it can lead to financial independence, and why consulting a qualified financial planner can be a game-changer in terms of achieving your financial objectives.

The Value of a Financial Strategy

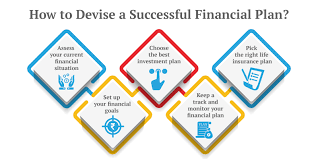

A financial plan is a roadmap that outlines your current financial situation, sets specific financial goals, and lays out the strategies and steps to reach those goals. It is a comprehensive guide to financial management and making informed financial decisions. Here is why everyone should have one:

1. Clarity and Direction: A financial plan clarifies your financial standing and assists you in establishing attainable goals. It guides your financial decisions and actions as a road map.

2. Goal Setting: With a financial plan, you can establish specific, measurable, and time-bound financial objectives. Whether you’re saving for retirement, purchasing a home, or paying off debt, your plan holds you accountable for achieving your goals.

3. Budgeting and Expense Management: A financial plan includes a budget that assists with the management of income and expenses. It ensures efficient resource allocation and prevents excessive spending.

4. Asset Allocation: It helps you allocate your assets across various investments, optimizing your portfolio according to your risk tolerance and financial goals.

5. Preparedness for Emergencies: A financial plan should include the establishment of an emergency fund to ensure that you are financially prepared for unforeseen expenses or setbacks.

6. Tax Efficiency: It enables you to make tax-efficient decisions, potentially lowering your tax liability and maximizing your after-tax returns.

7. Retirement Planning: A financial plan outlines your retirement savings strategy and ensures that you are on track to maintain your desired standard of living in retirement.

8. Debt Management: It provides a plan to manage and reduce debt strategically, allowing you to achieve financial independence more quickly.

9. Risk Management: A well-rounded plan incorporates insurance and risk management to safeguard your assets and loved ones against unforeseen events.

The Route to Financial Independence

Financial freedom is more than just accumulating wealth; it is achieving a state of financial security, independence, and flexibility in which one has options and autonomy. Here’s how a financial plan can help you reach your goals:

1. Setting Clear Goals: A financial plan helps you define your financial goals, whether it’s retiring early, traveling the world, or starting a business. With distinct objectives, you can tailor your plan to achieve these particular goals.

2. Budgeting and Savings: Your plan includes a budget to ensure that you live within your means and consistently save. This methodical strategy helps you accumulate wealth over time.

3. Investment Strategy: Your investment strategy is outlined in your financial plan, taking into account your risk tolerance and time horizon. Smart investments can increase your wealth over time.

4. Debt Reduction: If you have debts, your plan includes strategies for reducing and eventually eliminating them. Reducing your debt makes more of your income available for savings and investments.

5. Emergency Fund: A financial plan emphasizes the importance of an emergency fund, which provides a financial safety net for unforeseen expenses. This prevents you from dipping into your long-term savings during times of crisis.

6. Tax Efficiency: Your plan incorporates tax-efficient strategies to minimize the impact of taxes on your wealth, allowing you to retain a larger portion of your earnings.

7. Retirement Planning: Planning for retirement is a crucial component of financial independence. Your financial plan details how much you need to save for retirement as well as the most effective strategies for achieving this objective.

8. Review and Adaptation: As your life changes, so should your financial plan. Adjustments are made as necessary to ensure that you stay on track toward financial independence.

Advising a Financial Advisor

Look for a financial planner who specializes in comprehensive financial planning to assist you in achieving financial independence. Pacific Wealth can provide individualized advice, customize a financial plan to your specific circumstances, and ensure that your financial decisions are in line with your long-term goals. Choose a financial planner with a track record of assisting clients in attaining financial independence and who shares your vision of a financially secure and independent future. The appropriate financial planner can serve as your partner in achieving your financial objectives.

Your Journey towards Financial Independence

Financial independence is a worthy goal that is attainable for everyone with the right plan and direction. A well-structured financial plan is your tool to gain clarity about your financial goals, make informed decisions, and set yourself on a path toward financial security and independence.

Remember that financial independence is not about amassing vast wealth; it’s about being able to live life on your own terms, free of financial stress and constraints. With a clear plan, a disciplined approach to budgeting and saving, and the assistance of a qualified financial planner, you can embark on a path toward the financial independence you deserve. Start now and take the first step towards a financially secure and fulfilling future, find more here.